Worry no more! We've got an epic deal on PREPAID

tax prep fees that'll make tax season a breeze and leave you with inner peace!

Pay Now. File Later.

SAVE BIG!

Hurry! These Rates exp. 12/15/2024

Pay Now. File Later.

SAVE BIG!

Prepaid Tax Preparation Fees Offer Several Benefits

Low Price

Prepay to lock in a low price and save up to 50% or more on tax preparation fees!

Less Stress

Avoid last minute stress. Prepare at your leisure throughout tax season, with our guidance & without the fee increase.

Save Money

Most importantly, keep more money in your pocket! Prepaid rates offer significant discounts on our regular tax prep fees.

Prepaid Tax Packages

Pick the option that fits your situation

Prepaid fees can be used with refund loans!

Cannot be used for past years or amendments.

1040 - 25$

W-2 income

No dependents

No deductions beyond the standard deduction

No additional tax forms required.

1040 - 100$

W-2, 1099s

Dependents

Additional Income (Schedule B) or a small business (Schedule C no major deductions)

No complex deductions.

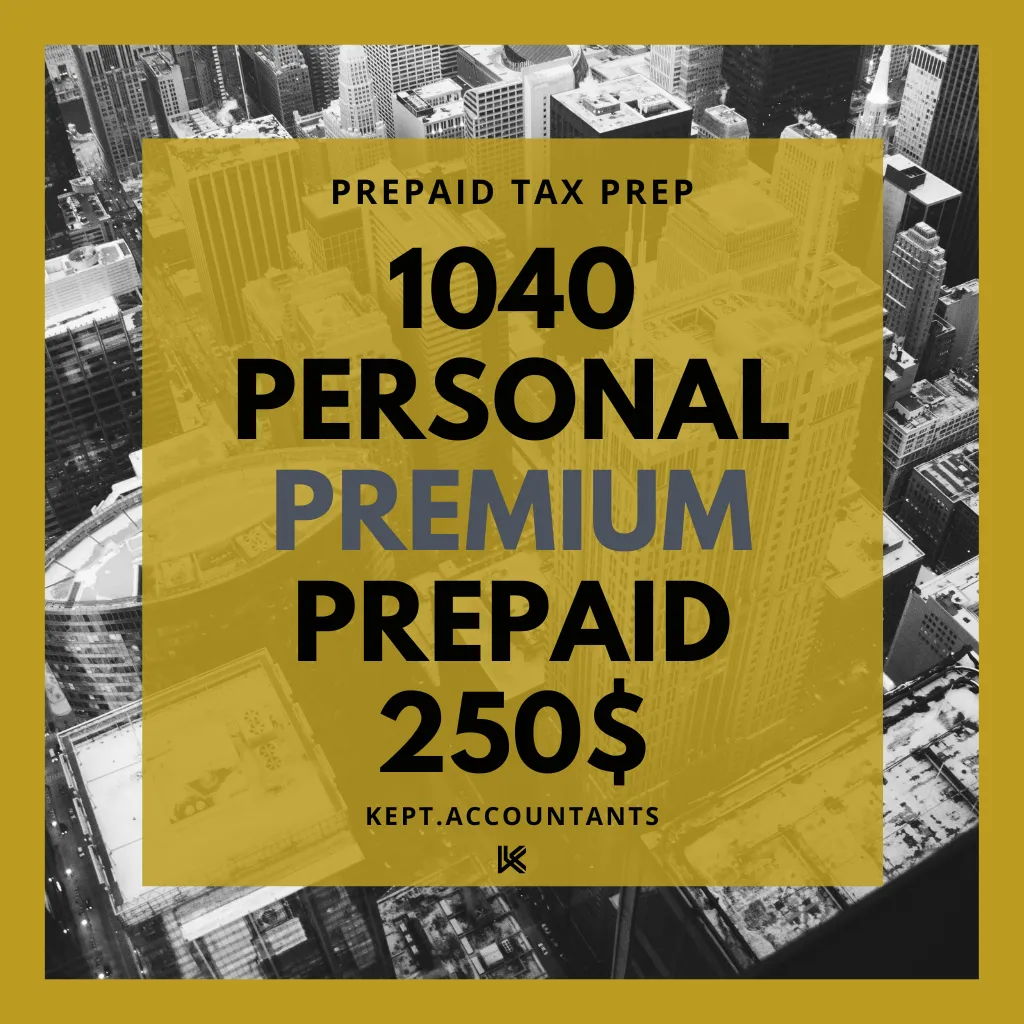

1040 - 250$

More complex situations

Multiple income sources

Rental properties (Schedule E),

Itemized /Complex deductions (Schedule A, Schedule C)

Retirement account withdrawals.

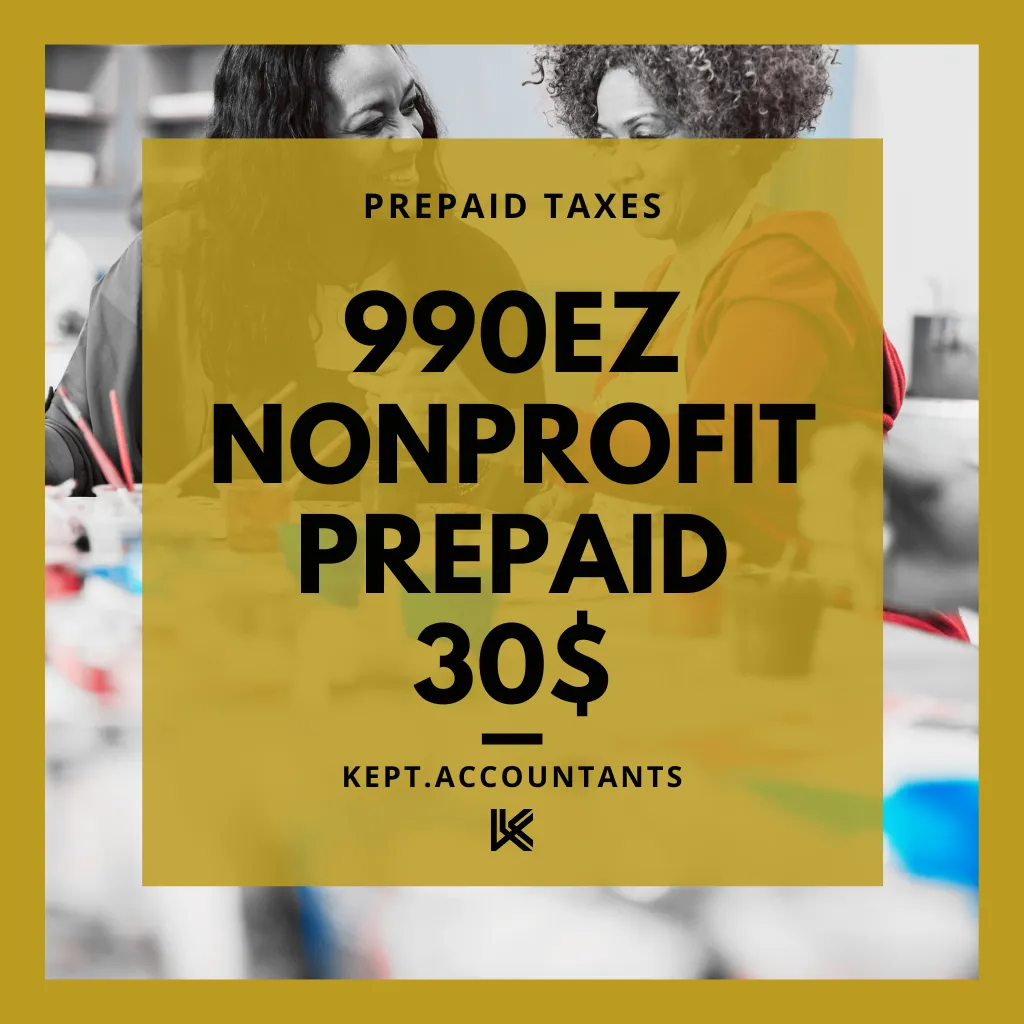

990 EZ - 30$

501(c)(3) w/ up to 200,000$ in gross receipts.

Nonprofits with gross receipts less than 50,000$ file 990N, for free directly w/ the IRS.

1065 - 400$

Form 1065 Partnership

Less than 5 partners (Schedule K-1)

1065 - 600$

Form 1065 Partnership

Up to 10 partners (Schedule K-1)

1120S - 500$

1120S

Up to 2 Shareholders (Schedule K-1)

Gross receipts up to 500,000$.

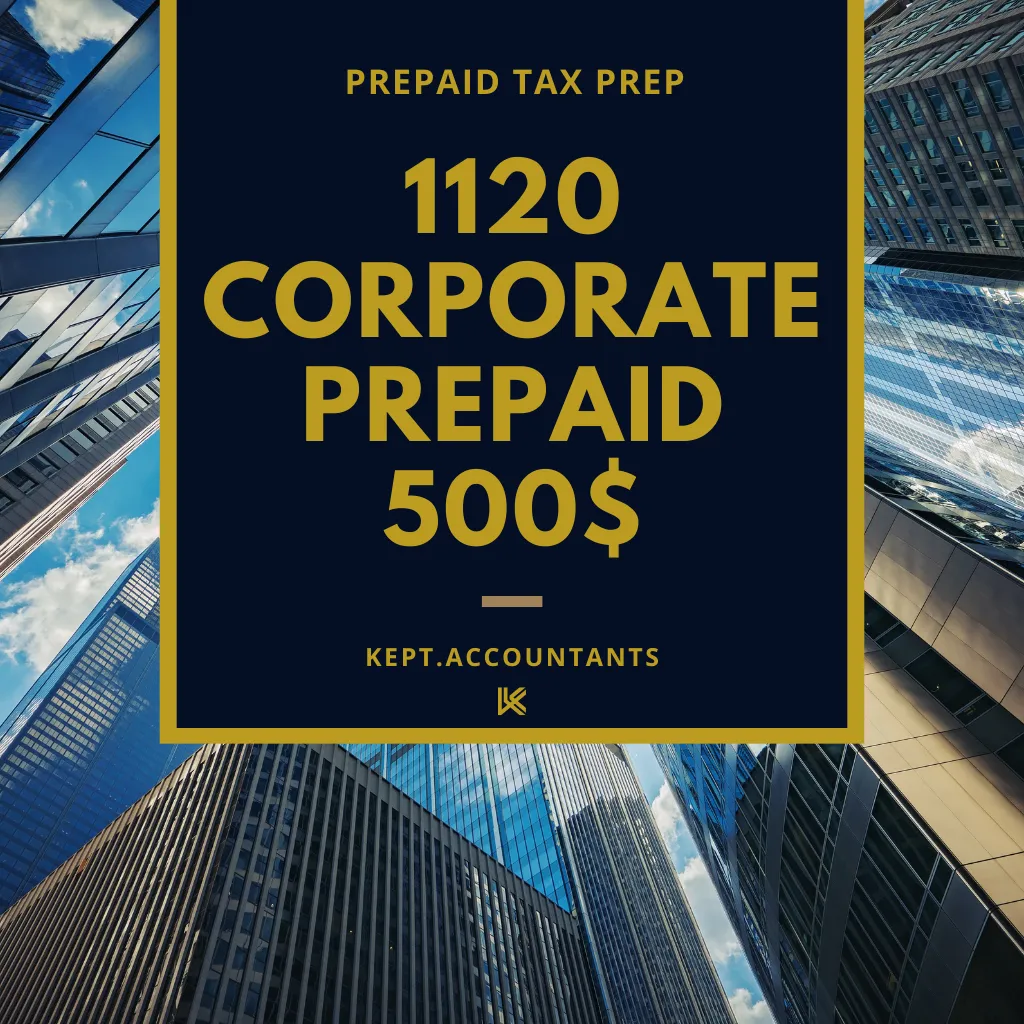

1120 - 650$

1120S up to 3 Shareholders (Schedule K-1)

1120 up to 3 Shareholders (1099-DIV)

Gross receipts between 500,001 - 1M$.

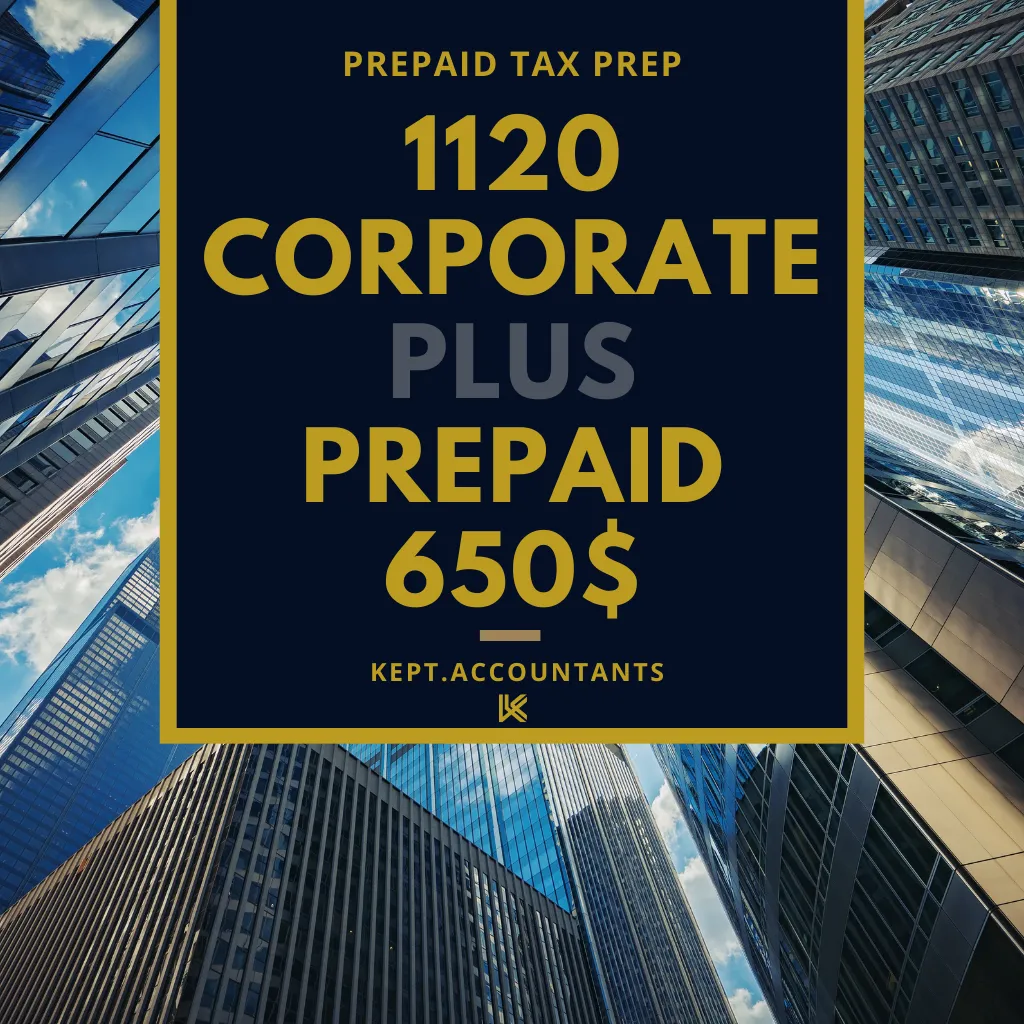

1120 - 800$

1120S up to 5 Shareholders (Schedule K-1)

1120 up to 5 Shareholders (1099-DIV)

Gross receipts up to 1,000,000$

Books a Mess?

We offer bookkeeping services to get and keep you organized.